In October 2023, the Government introduced changes to the way Shared Ownership annual rent increases are calculated. Homes England’s standard model lease uses the Retail Price Index (RPI) as a measure of inflation to calculate annual rent increases. In future leases, RPI is replaced with the Consumer Price Index (CPI)

In this feature, we explain what this could mean for you – i.e. how rent increases calculated using CPI+1% compare with rent increases calculated using RPI+0.5%, and who will benefit.

What is RPI?

RPI is the older of the two inflation measures. The Office for National Statistics (ONS) measures RPI by checking the price of goods and services in a typical ‘shopping basket’. The items used to assess inflation are updated as our shopping habits change. For example, e-bikes have recently been added, and digital cameras removed.

RPI includes mortgage interest payments, meaning it is heavily influenced by house prices and interest rates.

What is CPI?

CPI stands for the Consumer Prices Index. It includes the same goods and services as RPI, but does not take account of housing costs. CPI typically comes out lower than RPI. For example, in October 2023, RPI was 6.1% and CPI was 4.6%.

RPI vs CPI

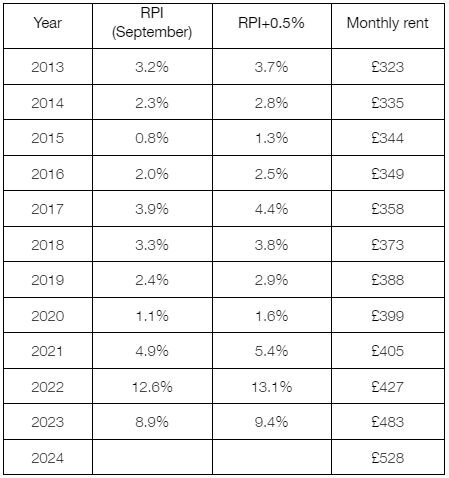

Meet Charmaine, a fictional Shared Owner. Charmaine purchased a 25% share of a new-build Shared Ownership house in southeast England in November 2013. Her home was valued at £188,000 and Charmaine paid £47,000 for her share.

Charmaine’s initial rent was calculated as 2.75% of the value of the landlord’s share (£141,000). Her annual rent increase is calculated using RPI+0.5% (based on the rate of RPI published in September the previous year).

Some Housing Associations capped annual rent increases at 7% in 2023, but not all. In this example – for consistency - we have assumed that Charmaine’s Housing Association did not cap rents.

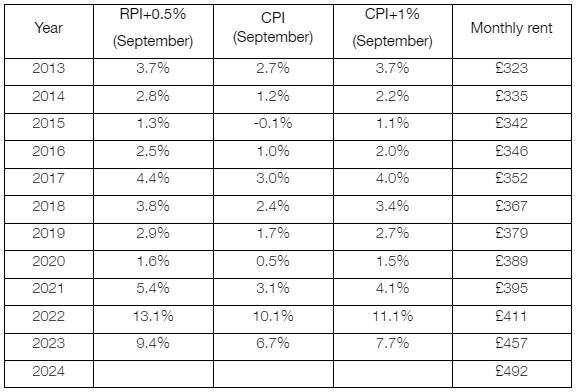

And this is how Charmaine’ rent increases would have looked if they had been based on CPI+1%.

Charmaine’s rent has increased more slowly under the CPI+1% formula than the RPI+0.5% formula. Under RPI, she is paying £528 each month by 2024, whereas under CPI her monthly rent is £492.

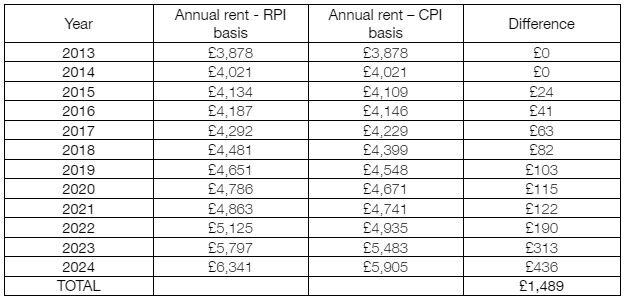

How much would these differences add up between 2013 and 2024?

As you can see, the differences between the two formulas for calculating annual rent increases start off small, but can add up over time.

Why is the Government phasing out RPI?

The Office for National Statistics (ONS) says:

RPI is a very poor measure of general inflation, at times greatly overestimating and at other times underestimating changes in prices and how these changes are experienced.

Adding:

We do not think it is a good measure of inflation and discourage its use. There are other, better measures available and any use of RPI over these far superior alternatives should be closely scrutinised.

Consequently the Government has committed to phasing out RPI entirely by 2030.

Will the new reforms benefit me?

It depends. The Government’s rent reforms are not retrospective. And the model Shared Ownership lease strongly implies that the ‘upwards only’, RPI-linked basis for annual rent review will continue to apply until the ONS stop publishing annual RPI rates of inflation.

You can find the relevant lease term, under the heading ‘Upwards only rent review’. It includes the statement: ‘if the index ceases to be published’.

Upwards only rent review

If the Index ceases to be published then there shall be substituted in the calculation in paragraph 3.1.2 such other index as the Landlord shall (acting reasonably) determine as being a generally respected measure of the general increase in retail prices.

This led many people to anticipate Shared Ownership leases transitioning to a new measure of inflation as and when RPI rates are no longer published.

Can my Housing Association change my rent review basis from RPI to CPI before 2030?

Homes England’s amended Capital Funding Guide now states that their permission is not required for housing providers to amend the Rent Review schedule in existing Shared Ownership leases to include CPI being used as the relevant index.

However, if Housing Associations amend existing contracts before the RPI Index ‘ceases to be published’ they would need to agree a Deed of Variation for each Shared Ownership lease. This could be time-consuming and costly.

Do your own research!

Whether your own lease specifies the ‘standard’ RPI-based annual rent review, or the ‘new’ CPI-based annual rent review, will depend on whether it commences before or after the date the Government introduced the new Shared Ownership rent reforms - on 12 October 2023. It will also depend on whether your Shared Ownership falls under ‘transitional arrangements’, which could mean you have the ‘standard’ rent basis even if you buy your share after 12 October 2023. It’s complicated! If you are buying a Shared Ownership home, make sure to check rent arrangements with your sales team and your solicitor.

Additional resources

GOV.UK – Shared Ownership rents reform

The Times, Money Mentor – CPI vs RPI inflation: what’s the difference?