Shared Ownership is often described as a ‘foot on the property ladder’. So what exactly is a ‘foot on the property ladder’, and how easy is it to make a profit when you sell your Shared Ownership home?

A foot on the property ladder

The Cambridge Dictionary provides a useful definition of the property ladder:

A series of stages in owning property in which you buy a small house or apartment first, and then buy a bigger or more expensive one when you have enough money.

The first house, or flat, you buy to get on to the property ladder is often described as a ‘starter home’. For some people, their ‘starter home’ may also be their ‘forever home’. But if you want to progress up the property ladder, you will probably need to make a profit on selling your Shared Ownership home to put towards your next home purchase.

We’ll start off with some information that applies to anyone buying and selling a home, and then move on to look at additional aspects that apply specifically to reselling a Shared Ownership property.

Property markets

Property markets can go up and down. You will need the value of your share to rise by more than the total selling costs in order to make a gain on sale.

New-build premium

If you bought a new-build home, you probably paid a new-build ‘premium’. This is the difference between the cost of your new-build home and a similar home that is not a new-build. One RICS valuer has estimated that new-build premiums on Shared Ownership homes are between 5% and 15% (subscriber access only).

Let’s say you bought a 25% share of a new-build home with a market value of £200,000. Your share cost £50,000. Assuming the new-build premium is calculated as 10%, the value was £45,455 before adding the premium.

£45,455 (value) + £4,545 (10% new-build premium) = £50,000 (sales price)

When you come to sell your home, the new-build premium won’t apply to the same degree as when you bought your property and everything was brand spanking new, and came with guarantees and warranties. Let’s assume the property market has been static in your local area – generally speaking, prices haven’t gone up, and they haven’t gone down. In that case, your home will be worth less – hopefully more than £45,455 but almost certainly less than £50,000.

In order to break even you need your local property market to rise sufficiently to ‘catch up’ with the premium you paid for your share and to cover your selling costs.

New build premiums will apply to all new build properties, not just Shared Ownership.

New-build premiums in a rising property market

In a 2021 feature for The Financial Times – The problem with new-build property - financial journalist, Neil Hudson, says:

Over the short-term (three years or less), new-build homes tend to sell for a higher price than suggested by local price trends. But this reverses rapidly in the following years.

Adding:

Our research finds that new-build homes sold seven years after they were built had, on average, underperformed the local benchmark by around 10 percentage points. So, if house prices in the local market had risen by 30 per cent over the period, then the price of an average new-build home had only risen by 20 per cent. But this varies by location, possibly reflecting the type and quality of both new and existing homes in the local market.

New-build premiums in a falling property market

In the same feature, Hudson says that buyers of new-build homes: “would be more exposed to negative equity in the event of house price falls”. However, he adds:

But buying any home comes with risk and, for many people, buying new-build will still be the right choice, especially if it helps them avoid large refurbishment costs or they value the better energy efficiency.

What does it cost to sell a home?

We’ll start by looking at costs that apply regardless of whether you are selling a Shared Ownership home, or any other type of residential property.

Estate agent fees

Sellers usually appoint an estate agent to market and sell their home. The process can be different for Shared Ownership homes, as you may need to allow your Housing Association a period of time to secure a buyer. However, if your Housing Association fails to secure a buyer, you may need to use an estate agent. Or your Housing Association may give you permission to go straight to the open market. (You can book a consultation with Stairpay here if you’d like to discuss how we can help with your sale).

Estate agents generally charge a fee based on a percentage of your home’s value. The HomeOwners Alliance found that estate agents’ fees typically range from 0.9% to 3.6%, with an average of 1.42%.

Bear in mind that estate agents will probably base their percentage fee on the ‘grossed up’ sales price of your home, not the price for the share you are selling. This is because it takes the same amount of work to sell a share as to sell an entire property.

Conveyancing fees and disbursements

Conveyancing is the term used to describe the legal process of transferring ownership from a seller to a buyer. Conveyancing solicitors specialise in the sale and purchase of residential properties.

Buying

Buying any home is expensive and potentially risky. When you bought this home, and when you are buying your next home, your solicitor will carry out searches to make sure there is nothing you need to know which could affect your decision to purchase this particular property.

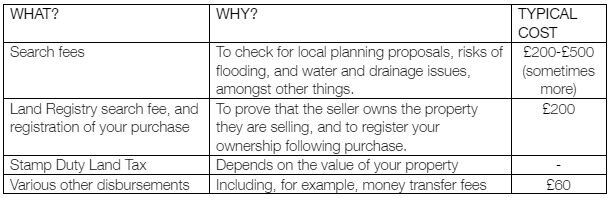

Your conveyancing costs will include legal fees and disbursements. Legal fees pay for the work carried out by your conveyancing solicitor. You could typically pay between £500 and £1,150 in legal fees when you are buying a property.

Disbursements are the costs that your solicitor pays on your behalf to third parties. You do not, generally, have to pay these upfront. Instead, they will be included in your final bill. The HomeOwners Alliance estimate that disbursements can add up to £700, or even more.

See our article on whether you should pay your Shared Ownership stamp duty upfront or in stages.

Selling

The same as when you bought your home, the conveyancing fees you pay when selling will include legal fees and disbursements.

You could typically pay around £1,000 in legal fees when you are selling a property. The precise amount will depend on how complex your sale is. For example, you are likely to pay more if you are undertaking a simultaneous sale and staircasing transaction (selling 100% of your home) rather than simply selling your share.

Disbursements could include: Land Registry official copy entries, money transfer fees, and archiving fees.

Leasehold Information Pack

If you are selling a flat, your buyer will need a Leasehold Information Pack (also sometimes known as a Leasehold Management Pack, or a Freeholder Pack). This is a bundle of documents, which provides key information on costs and risks associated with your home.

The Leasehold Information Pack include information on the following aspects:

- Service charges – A three-year service charge history

- Current service charge account balance and statement - Used to make sure that these are fairly apportioned between you and your buyer

- Ground rent information – If you pay ground rent then evidence of the monthly/annual charge, what you’ve already paid and any amounts still outstanding is used to fairly apportion ground rent between you and your buyer.

- Section 20 Notices – A Section 20 Notice outlines any work or service that shared owners/leaseholders will have to pay for.

- Planned works – The information pack will include details of any major planned works.

- Asbestos risk assessment – Communal areas only.

- Building insurance – Schedule and policy

- External Wall System information (EWS1) – If applicable.

- Management company – Details of the management company acting on the Housing Association’s behalf (if applicable).

Your solicitor will request a Leaseholder Information Pack from your Housing Association, and charge you for this along with any other disbursements.

If you pay service charges to a third party management company, you may also need to pay for a separate Management Company Information Pack. Your solicitor will deal with this on your behalf.

Energy performance certificate (EPC)

It is a legal requirement to make an energy performance certificate (EPC) available within the first 28 days of marketing a property. If your property already has an EPC you may be able to retrieve it from the GOV.UK site: Find an energy certificate. (https://www.gov.uk/find-energy-certificate) However, if it is not listed, or it is out of date, you will need to budget for an updated EPC. This could cost between £60 and £120.

Selling a Shared Ownership home

In this section, we’ll cover some additional costs that apply specifically to selling a Shared Ownership home.

RICS valuation fees

When you sell a home on the open market, your estate agent will advise on the best selling price. Estate agents often charge for their services on a percentage basis, so it is in their interests to sell your home for the highest price they can get.

The process is different if you are selling a share in a Shared Ownership property. Your Housing Association has the right to find a buyer during a specified period of time, known as the nomination period. This could be 4, 8 or 12 weeks, depending on your lease. During the nomination period, you must sell your share at a price established by a RICS valuation. This is to ensure that your home is available at a fair price to potential buyers who meet eligibility criteria.

You will have to pay for the RICS valuation. As a rough estimate this could cost around £250. The valuation is valid for three months, and you may need to pay to update the valuation if the sales process takes longer than this. This won’t necessarily involve a full revaluation, so it could cost less than the original report.

Housing association assignment fee

The assignment fee is the fee your Housing Association may charge to find a buyer during the nomination period. This is likely to be set at a lower percentage than an estate agent would charge, perhaps 1%-1.25%, though your Housing Association may not provide the full range of services that an estate agent would offer.

Housing Associations are allowed to charge their percentage fee on the full value, not just the sales price for your share. Some do, though not all.

Housing association legal fees

You will probably have to pay your Housing Association’s legal fees as well as your own legal fees. As a rough guide, this could be around £500.

Selling a Shared Ownership home on the open market

If your Housing Association fails to find a buyer during the nomination period, you have the right to sell your home on the open market. You can either continue to market your share, or sell 100% of the property. Selling 100% is known as a simultaneous sale and staircasing transaction, or back-to-back sale. The buyer purchases 100% and you pay the Housing Association for their share from the sale proceeds.

You will still need a RICS valuation, as this acts as a ‘floor’ for the sales price. But, if you sell your home on the open market, you have the right to sell your home for a higher price than the RICS valuation. In this case, you get to keep any difference between the RICS valuation and the actual sales price.

What happens if I sell for less than the RICS valuation?

Different Housing Associations have different policies. If you sell for a price that is lower than the RICS valuation, some Housing Associations may require you to cover the loss on their share as well as on your own.

Meet our shared owner, Otis

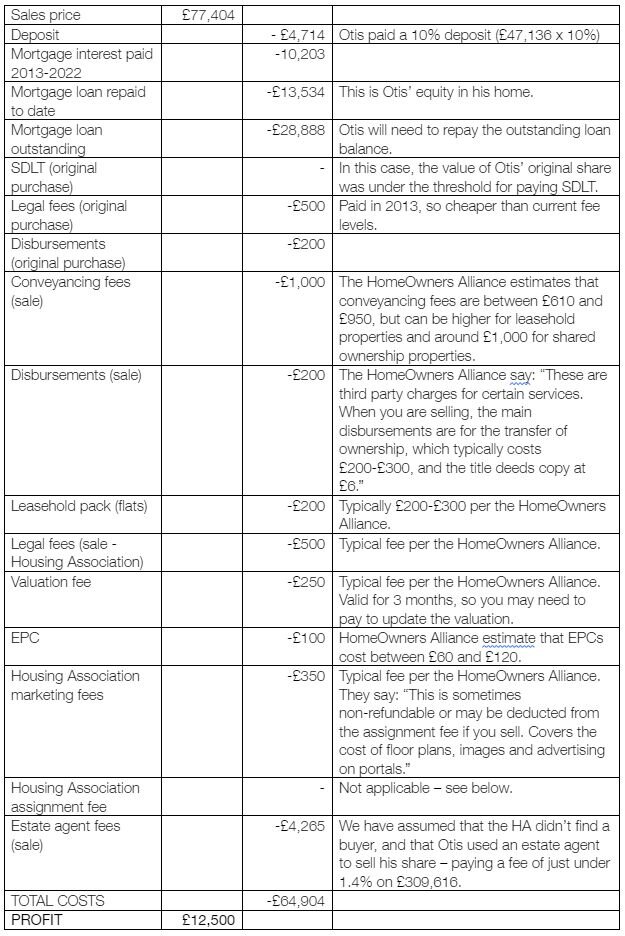

In our feature ‘How does Shared Ownership work when I sell?’, we met Otis – a shared owner hoping to sell his Shared Ownership home. Otis paid £47,136 for his 25% share in 2013. He’s obtained a RICS valuation of £309,616 (the average property price in August 2023), so the sales price for his 25% share is £77,404. How much gain is he likely to make on his sale?

It’s not as straightforward as subtracting £47,136 from £77,404. Otis incurred costs in purchasing his share, and he will incur costs in selling it. We’ll talk through what these costs could add up to, how much profit he might make, and how much cash he might end up with to put towards his next property purchase.

We’ll assume that Otis paid a 10% deposit (£4,714) when he bought his 25% share, so his mortgage was for £42,422. We’ll also assume that his mortgage term was 25 years.

Other costs

In the example above, we’ve only included costs directly associated with buying and selling.

We haven’t included rent because it is a cost associated with the share not being sold. We also haven’t included service charges, as these are payment for services during the period of occupation rather than a cost of buying and selling.

It is also worth bearing in mind that mortgage interest rates have been on the rise in recent years. Otis’ profit would have been lower if his mortgage interest rate had been higher between 2013 and 2022.

How much profit do I need to make?

There are two ways of looking at this. First, you might be interested in whether your Shared Ownership home has been good value for money; say, compared to renting privately or purchasing a home on the open market. This involves looking at all the costs you’ve incurred, including mortgage interest. Understanding your total housing costs, and your profit (or loss), could help you think through your next move, which might be to buy another Shared Ownership home or purchase on the open market.

Second, you need to plan to have sufficient cash, after selling, to cover the deposit for your next home purchase, any Stamp Duty Land Tax (SDLT) due, and legal and valuation fees. As you will no longer be a first-time buyer, the threshold for SDLT will be lower than it was when you purchased your share in a Shared Ownership home.

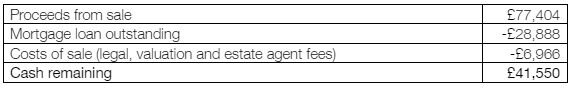

How much cash will I have towards my next home purchase?

It is important to remember that cash and profit are not the same thing.

The amount of cash Otis has following his sale is not the same figure as his profit. His profit figure takes account of all his costs since he bought his first share (though we have excluded rent and service charges). However, he has already paid many of those costs over the past 10 years (for example, monthly mortgage interest payments). When it comes to working out how much cash he has towards his next home purchase, he simply needs to take account of costs that come out of the proceeds from his sale.

Don’t forget to budget for removal costs, and any mortgage penalty fees or early redemption fees (if applicable).

Do your own research!

We’ve used a scenario to illustrate the types of costs involved in buying and selling a home. But it is important not to place too much reliance on this scenario. Housing association fees vary considerably, as do professional legal and valuation fees. Prevailing mortgage interest rates will also have a large impact on how much it will cost to repay your mortgage loan.

This feature is not intended to substitute for expert, regulated financial advice. If you are considering selling your home, it is essential to take professional advice.

Additional resources

Unbiased – What does your conveyancing solicitor do?