Moving house regularly comes up in lists of the most stressful life events. Fortunately, there’s a lot of information available online to help homeowners navigate the selling process. However, selling a Shared Ownership home can be more complex than selling other types of property.

This article will help you understand why it might be more challenging to sell a large share than a smaller share, and assess some options to increase your pool of potential buyers.

The government recently introduced a number of reforms to the Shared Ownership scheme, so we’ll also discuss what impact these might have on selling your Shared Ownership home.

RICS valuation

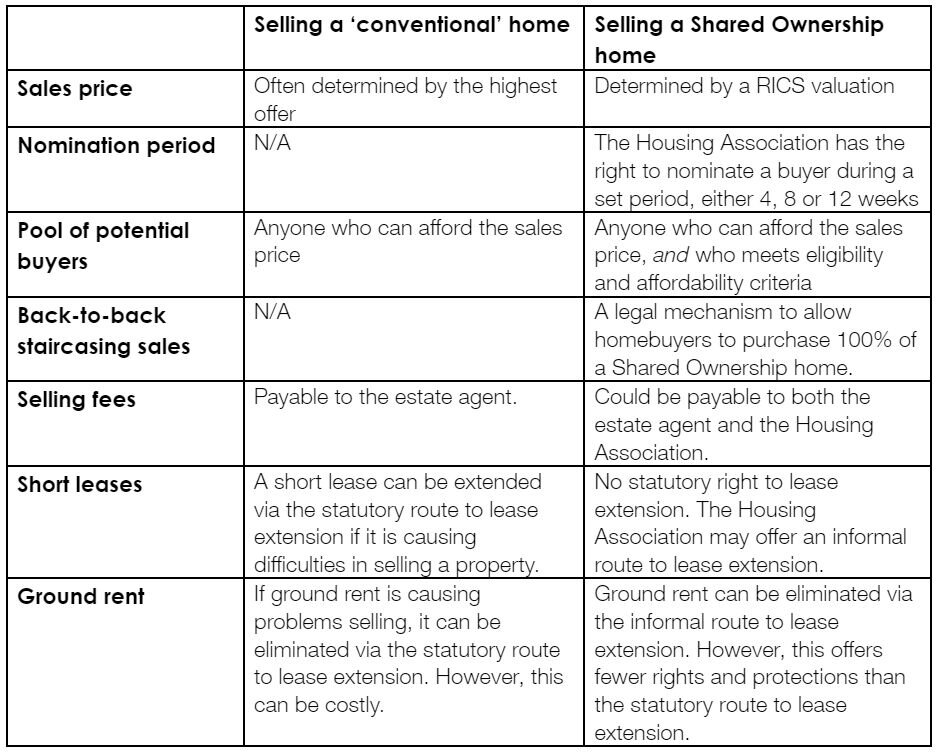

When someone sells a home, generally speaking, his or her estate agent will advise on how to achieve the best price. They’ll suggest a pricing strategy, such as pricing high to assess buyer interest or pricing low to encourage a bidding war.

But it’s different when you sell a Shared Ownership home. You have to pay a RICS (Royal Institution of Chartered Surveyors) valuer to estimate the ‘open market value’ of your home. This establishes the sales price during the ‘nomination period’.

If you haven’t yet got a RICS valuation for your home, you might benefit from checking out our partner Homemove.

Nomination period

If you decide to sell your share, your Housing Association has the right to find a buyer during a set period of time, known as the ‘nomination period’. Depending on the date of your lease, the nomination period could be 4, 8, or 12 weeks. (The nomination period was reduced to 4 weeks under recent reforms applicable to new leases).

Your housing association may even allow you to go straight to the open market.

Potential buyers

The purpose of the nomination period, and the requirement to sell at the RICS valuation, is to ensure that Shared Ownership homes continue to be made available to households who are eligible for the scheme. Potential buyers must meet specified criteria, including that they cannot afford to purchase a home on the open market.

Initial eligibility and affordability

Outside London, only households with a gross income below £80,000 can purchase a Shared Ownership home. In London, the upper threshold for purchasing a Shared Ownership home is £90,000.

There isn’t a minimum income for households purchasing a Shared Ownership home. However, to ensure that households don’t overstretch themselves, Homes England suggests that total housing costs (mortgage, rent and service charge) should be between 25% and 45% of a household’s net annual household income. (Net income is gross (total) income minus income tax and National Insurance payments). The upper limit for anyone purchasing a Shared Ownership home in London is 40%.

Homes England has published a calculator to help financial advisors and mortgage advisors assess whether applicants to the Shared Ownership scheme meet eligibility and affordability criteria. They say:

The calculator has been created by Homes England to provide a tool for Help to Buy agents and Registered Providers to make an initial assessment of applicants’ eligibility for shared ownership, together with their ability to afford and sustain it over a period of time. In addition, it provides a tool to give an initial indication of the maximum contribution an applicant can make to purchase a shared ownership property using public funds, and an indication of the maximum share they could afford.

According to Homes England:

The eligibility and affordability calculator is not intended to provide a definitive affordability assessment. It is expected that such an assessment would be undertaken by a mortgage lender and /or Independent Financial Advisor (IFA) following the initial check that this tool provides.

IMPORTANT NOTE: Homes England points out that their initial eligibility and affordability calculator isn’t designed to work for resales. However – in the absence of a bespoke tool for resales – we’ve used the calculator to inform a number of scenarios in order to explain some affordability issues that sellers might need to be aware of. Sellers (and homebuyers) should not place reliance on the calculations in this article. Homebuyers should seek advice on their own personal eligibility and affordability from an independent financial advisor with expertise in Shared Ownership, or a mortgage lender.

Meet our shared owner, Otis…

Otis purchased a 25% share of a two-bedroom, new-build Shared Ownership house in southeast England in December 2013. His home was valued at £188,544 (the average price for a property in England that year according to the Office for National Statistics) and Otis paid £47,136 for his 25% share.

Otis is now considering selling his share, and he’s wondering how easy it will be to find a buyer.

He’s obtained a RICS valuation of £309,616 (the average property price in August 2023), so the sales price for his 25% share is £77,404.

His initial rent was £324pcm. Per the Annual Rent Review term in his lease (Link to - What rent do you pay on Shared Ownership?), his rent has increased by RPI+0.5% each year since then, so he is currently paying £484pcm. His service charges were £50pcm in 2013, ten years ago, and have now risen to £100pcm.

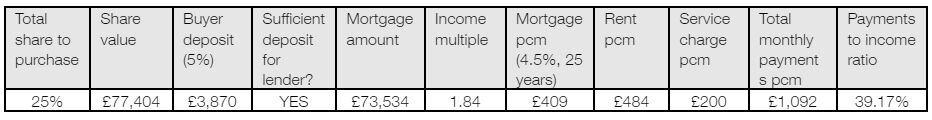

EXAMPLE 1 – Selling a 25% share

As we’ve already discussed, any potential buyer would need to meet eligibility and affordability criteria.

In this example, we’ve assumed that a potential buyer for Otis’ share – let’s call him Jaden - has a gross household income of £40,000, and has saved a 5% deposit of £3,870. We’ve also assumed that Jaden has no debts, and pays 3% of his gross salary (the minimum allowable) into a pension scheme.

Jaden meets Homes England’s eligibility criteria, as his income is below the maximum £80,000 ceiling for Shared Ownership homes outside London. He’s comfortably below the 45% payments to income ratio ceiling, so he’s confident he can afford Otis’ 25% share.

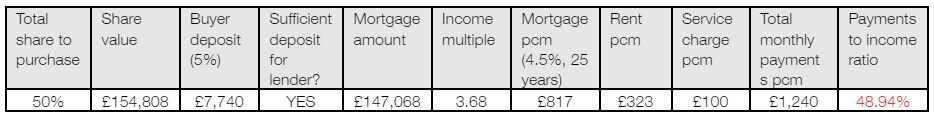

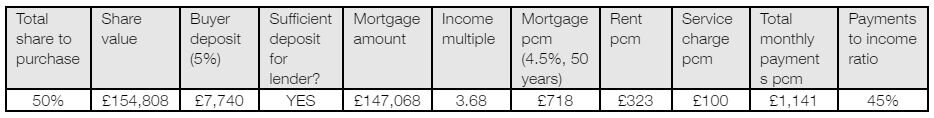

EXAMPLE 2 – Selling a 50% share

In this example, we’ve assumed that Otis has staircased to 50% since purchasing his initial share. His share for sale costs £154,808, so a 5% mortgage deposit is £7,740. Compared to buying a 25% share, total monthly payments (mortgage, rent and service charge) have increased from £992 to £1,240.

Although Jaden has saved enough money to afford the larger deposit, his payments to income ratio is now 48.94%, meaning he fails the initial affordability test of 45%.

This example demonstrates how staircasing from 25% to 50% could reduce the pool of potential buyers when you come to sell.

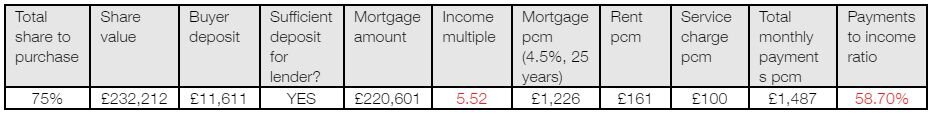

EXAMPLE 3 – Selling a 75% share

Next, we’ll look at the situation if Otis had staircased to 75%. Jaden now fails two affordability tests. His payments to income ratio has risen to 58.70% (significantly above the recommended upper limit of 45%). And he also fails to meet the test that his mortgage shouldn’t be more than 4.5 times his annual income.

It’s quite possible that anyone who could afford a 75% share might prefer to purchase a home on the open market instead.

Tackling affordability

In these first three examples, we’ve seen how staircasing could limit the pool of potential buyers. (Purchasing a large initial share could have the same effect, assuming property prices rise faster than incomes).

But Jaden still has a few options to investigate if he’s keen to buy Otis’ 50% share. His situation would be different if he was purchasing with someone else, and their combined household income was higher than his income alone. However, we’ll assume - for the time being - that he is purchasing as a single person and that he has no options to increase his income, in the short-term at least. He could put down a larger deposit or he could pay back his mortgage over a longer period of time. We’ll look at both these options in the following two examples.

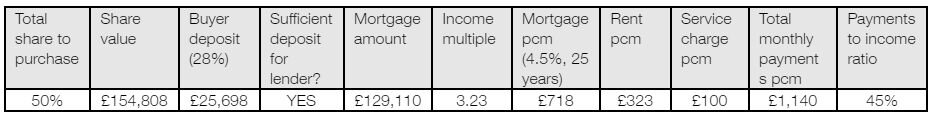

EXAMPLE 4 – Selling a 50% share (buyer puts down larger deposit)

In the example below, we show that Jaden would need to put down a deposit of around £25,700 (just under 17% of the sale price) to achieve a 45% affordability ratio.

Putting down a larger mortgage deposit could help potential buyers meet required affordability ratios.

Some people could struggle to save such a large deposit. However, other buyers might have a large sum of cash from an inheritance, or perhaps the sale of a former family home following a relationship breakdown.

For consistency, this example assumes the same mortgage interest rate of 4.5% as the other examples. But, in real life, putting down a significantly larger deposit should result in a better mortgage deal. However, our intention here is simply to illustrate – in a relatively straightforward way - the principle that there could be a smaller pool of potential buyers for larger shares.

EXAMPLE 5 – Selling a 50% share (buyer takes out long mortgage term)

Let’s assume Jaden can’t afford to put down a large deposit on Otis’ 50% share. Can he pay back his mortgage over a longer period of time? Homes England’s eligibility and affordability calculator suggests that he would need to increase his mortgage term to around 33 years to bring his affordability ratio down to 45%. However, assuming he could obtain a 33-year term, the total interest payments would be considerably more than on a 25-year mortgage, making the loan poorer value for money.

Can a buyer purchase a smaller share?

You might be wondering if one way around affordability issues is for potential buyers to purchase a smaller share. Unfortunately, on a resale, you can’t accept an offer for a lower percentage share than you actually own.

Can a buyer purchase a larger share?

Let’s say, Otis is selling a 25% share. And let’s assume Jaden is now purchasing with a partner. Between them, Jaden and his partner can afford a 45% share. In this case, they can buy the 25% share from Otis and the remaining 20% directly from the Housing Association.

Selling a part share vs selling 100%

In the previous examples, we’ve shown why it could be more challenging to sell a larger share than a smaller share. But does this mean that it’s impossible to sell a large share? Not at all! If your Housing Association fails to find a buyer during the nomination period, you can take your home to the open market. You can continue to market your share. However, you will also have the option of selling 100% of your home.

5.3.38 If the provider is unable to nominate a suitable purchaser within the specified nomination period as set out in the lease (and does not intend to take a surrender of the lease), under the terms of the lease the owner will be able to sell the property on the open market at a price below, above or the same as the independent RICS valuation. In practice, this will often mean that the shared owner will perform a ‘back-to-back’ staircasing sale. That is, they will staircase to 100% ownership and sell the property outright simultaneously.

Homes England, Capital Funding Guide

How does this work? ‘Back-to-back’ staircasing sales (also known as simultaneous sale and staircasing transactions) are a legal mechanism to allow your buyer to purchase your share and your landlord’s share at the same time.

Following the nomination period, you can market your home above the RICS valuation. If your buyer pays more than the RICS valuation, via a back-to-back sale, you gain the benefit of all of the increase in the price received (over the RICS valuation). Your landlord will receive its share (from the staircasing transaction up to 100%) as per the RICS valuation.

Bear in mind that, if you undertake a back-to-back sale you could end up paying fees to both the Housing Association and the estate agent.

What happens if I make a loss on sale?

We’ve explained what happens if you sell your Shared Ownership home, following the nomination period, for a price which is higher than the RICS valuation.

The opposite applies if you complete a back-to-back staircasing transaction for a price lower than the RICS valuation. In that case, your landlord’s share is ‘protected’ by the RICS valuation. If the sales price achieved is lower than the RICS valuation, you could be required to bear all of the loss – both the loss on your own share and the loss on your landlord’s share.

Different Housing Associations explain this in different ways:

If you sell 100% of the property below the valuation, you will be required to make up the difference on Clarion’s share.

Clarion – Selling your home with Clarion Housing

You would not be able to accept a lower offer than the RICS valuation unless you’re prepared to take the full shortfall (not just the % share you own). You will be able to accept a higher offer. Where this is achieved, you will be able to keep 100% of the additional monies received.

L&Q – Selling your Shared Ownership home

No cheeky offers – If the estate agent sells the property on a Shared Ownership basis, the property cannot be sold any lower than the current RICS valuation report.

Peabody – Moving on, made easy: a guide to selling your Shared Ownership home

Short leases

Historically, Shared Ownership homes were sold with ‘short’ 99- or 125-year leases. These leases are described as ‘short’ because it is much more expensive to extend a lease once there are fewer than 80-years remaining. The government has recognised that costs associated with extending a short lease can be problematic. For this reason, Shared Ownership homes delivered under the ‘new model’ come with 990-year leases.

But the ‘new model’ 990-year leases aren’t retrospective. Consequently, if you have a relatively low number of years remaining on your lease – say, 85 years or below – you may find it more challenging to sell your share.

If you’re selling a Shared Ownership house, you may be able to address the problem of a short lease via a back-to-back sale. Staircasing to 100% could obtain the freehold. However, staircasing to 100% won’t obtain the freehold of a flat, or a leasehold house. And this won’t be an option for shared owners whose lease terms cap staircasing below 100%: for example, in some rural schemes.

Ground rent

A ‘ground rent’ is a payment paid by residential leaseholders to their landlord. The landlord does not have to provide a clear service in return. Historically Shared Ownership properties were offered with peppercorn ground rent (effectively zero). However, ground rent terms have been introduced into some Shared Ownership leases.

The government recently abolished ground rent for new leases of flats and houses in England and Wales, as part of the Leasehold Reform (Ground Rent) Act 2022. However, this reform is not retrospective, so the only way to remove ground rent is to undertake a lease extension. Unfortunately, shared owners do not have access to the statutory route to lease extension, which decreases any ground rent to a peppercorn. The informal route to lease extension does not offer the same right.

Summary

We’ve summarised some key differences between selling a ‘conventional’ home and selling a Shared Ownership home in the table below.

Do your own research!

When it comes to selling any home, it’s a moving picture. Property markets go up and down, and mortgage interest rates go up and down.

When it comes to Shared Ownership specifically, a range of factors will affect how easy it is to sell your home. This could depend on: whether you’re selling a large or a small share; whether your Housing Association has a waiting list of potential buyers for homes like yours; whether you’re selling a flat or a house; the number of years remaining on your lease; and whether or not you’re liable for ground rent.

Housing Associations vary so make sure to look into your own landlord’s resale policies and procedures.

Additional resources

GOV.UK - Shared ownership homes: buying, improving and selling