Shared Ownership rent is often described as ‘reduced’, ‘subsidised’, ‘discounted’ or ‘affordable’. But what does this actually mean and how much rent will you pay?

In this feature we explain how your initial rent is calculated, and how annual rent reviews work.

Initial rent

Your initial rent should be lower than market rent on similar homes in your area. (Though don’t forget to factor in service charges. Private tenants don’t pay a separate fee for repairs and maintenance, whereas shared owners pay these costs via service charges.)

Initial rent is calculated as a percentage of the value of the share held by your landlord. The percentage used is often either 2.75% or 3%.

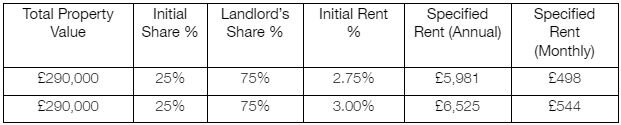

Let’s assume you purchased a 25% share in a house worth £290,000 (the average UK house price in July 2023, per the Office for National Statistics).

As you can see, that seemingly tiny 0.25% difference between 2.75% and 3% can actually have quite an impact on your rent.

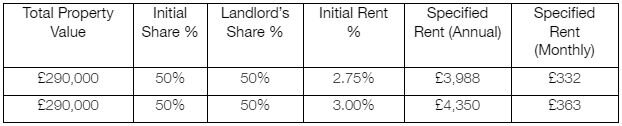

Now let’s assume you purchased a 50% share in the same house.

The larger your share, the smaller your landlord’s share is. And the smaller the landlord’s share, the lower your initial rent. On the other hand - unless you have purchased your initial share in cash - a larger share leaves you more exposed to mortgage rate fluctuations.

Annual rent review

Over time, prices tend to go up. This is known as inflation. And your rent is no exception!

Your lease contains details of when, and how, your annual rent increase is calculated. It’s generally based on RPI (Retail Price Index), which is a measure of inflation. Recent Shared Ownership leases are likely to calculate the rent increase as RPI plus 0.5%, or 0.5% (whichever is higher). Older leases may have different terms.

RPI has been rising in recent years. Consequently, shared owners have experienced higher rent increases than previously.

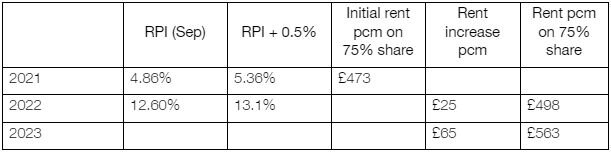

The following illustration shows the rent increase for someone who purchased a Shared Ownership home in December 2021. We assumed that their home was valued at £275,000 (the average UK house price at the time) and that they purchased a 25% share. We also assumed that their initial rent was calculated at 2.75% of the 75% share held by the landlord. This landlord’s policy is to calculate the annual rent increase using the previous year’s RPI as at September.

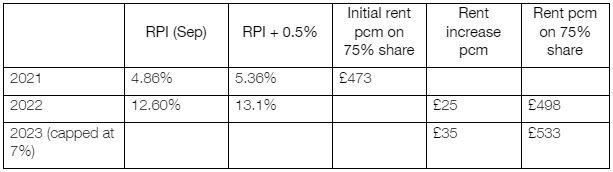

Due to the cost of living crisis, the government made a decision (in 2022) to cap 2023/24 social rent increases at 7%. The National Housing Federation (a trade body for housing associations) subsequently issued a statement committing its members (representing 80% of shared ownership homes) to match the cap for shared owners.

The following illustration shows how the rent rise would look for someone in the same situation but whose rent rise was capped at 7%.

TOP TIP – Rent rises often take place in a specified month. Depending what month your rent increase applies, and what month you complete your home purchase, you may find yourself facing a rent increase well before you’ve been in your new home for twelve months. Make sure to discuss this with your solicitor and/or financial assessor and to budget accordingly.

Is Shared Ownership rent ‘capped’?

Does the rent increase calculation mean that your rent increases are ‘capped’? Yes, and no. Your landlord cannot increase your rent by more than the higher of RPI plus 0.5%, or 0.5% (or whatever formula is specified in your lease).

Your rent will never increase by less than 0.5%. However, no one knows how high RPI might rise in the future, and there is no fixed upper limit on annual rent increases.

What does ‘upwards only’ mean?

The ‘upwards only’ aspect of annual rent reviews means that Shared Ownership rents always go up, even if inflation goes down. However, your rent increase is capped at 0.5% if the inflation rate dips below 0% (known as deflation).

Is Shared Ownership cheaper than renting privately?

Shared Ownership is often described as cheaper than renting privately. But this will depend on circumstance. The comparison relates to when you purchase your initial share. However, over time, Shared Ownership rent can rise to levels that are actually more expensive than local private rentals.

A great deal depends on where you live and whether private rents increase quickly or slowly, compared to inflation, in your local area. A research report published by Savills says: ‘While rental growth at a national level is roughly in line with RPI, this hides a great deal of regional variation’.

Shared Ownership rent reforms

On 12 October 2023 Homes England published a series of Shared Ownership rent reforms for new shared owners. These include changing the formula used to calculate rent increases and making it easier for housing providers to apply rent caps in the future. The reforms aren’t retrospective, so do not apply to current shared owners. We’ll cover the rent reforms in more detail in a separate article.

Do your own research!

The Shared Ownership scheme was designed in the 1970s when the wider economic environment made it more likely that shared owners could count on staircasing to 100%. In fact, the annual rent review policy was intended to ‘nudge’ shared owners towards staircasing.

But the number of Shared Ownership households staircasing to 100% is now relatively low. Make sure you understand what your own lease says about annual rent reviews and that you have a plan to manage, or eliminate, rent. Maybe you are confident that your income will keep pace with inflation to cover your annual rent increases. Or perhaps you plan to eliminate rent via staircasing to 100%, or by selling on.